Dye Autos Denver Area Truck and Automotive Blog

What Used Car Shoppers Need to Know About Credit Reports

Your credit report is one of the most important elements of your financial life. Whether you’re buying a home or car or qualifying for a new apartment, your credit report influences decisions. We sell a lot of used trucks and cars, and we’ve learned over the years that used car shoppers need to know about credit reports.

Your credit report is one of the most important elements of your financial life. Whether you’re buying a home or car or qualifying for a new apartment, your credit report influences decisions. We sell a lot of used trucks and cars, and we’ve learned over the years that used car shoppers need to know about credit reports.

Knowing what’s in your credit report saves time and money. You make better decisions and things go smoother when you’re at the dealership.

Here are some tidbits you should know.

You can obtain a free copy of your credit report.

FTC (Federal Trade Commission) Website: You’re entitled to one free copy of your credit report every 12 months from each of the three nationwide credit reporting companies. Order online from annualcreditreport.com, the only authorized website for free credit reports, or call 1-877-322-8228. You will need to provide your name, address, social security number, and date of birth to verify your identity.

Some states like Colorado have laws that allow you to get a free credit report in addition to the free annual credit report you’re entitled to by Federal law.

Always know your credit score.

If you plan on using financing to buy a used pickup truck, your credit score is key to getting the lowest interest rates. Your credit score is a three-digit number that uses your credit information to assess how risky a borrower you are, and it can significantly influence how lenders decide the terms of your loan.

The higher your credit score, the lower your risk and the lower your interest rate. The lower your credit score, the riskier you are and the higher your interest rates. Be proactive in checking your credit score beforehand so you know where your credit stands before you apply for a loan.

Take advantage of Fair Isaac’s free credit education.

Put some time into understanding how credit works and how your credit scores will be impacted by your actions—late payments, opening a new line of credit, etc.

Fair Isaac Tools—creators of the FICO credit score—have several tools that can help you understand credit scores, including a free credit score estimator and a loan savings calculator.

All the “Credit Basics” are located at myfico.com

Understand all the ways you can boost your credit.

Here are the ways to bring up your credit score:

- Make sure your open accounts are in good standing.

- Pay all your bills on time – even those that aren’t’ on your report.

- Keep accounts out of collections.

- Reduce your balances and keep them low.

- Make sure your credit limits are reported correctly.

- Leave old accounts open and keep them active.

- Open new accounts sparingly.

- Have different types of accounts.

- Clean up any negative items.

Used car shoppers need to know about credit reports.

Because so many businesses use your credit report to make decisions about you, it’s important that you check your credit report at least once a year to be sure the information in your credit report is accurate.

Need help with choosing your dream pickup truck or car that fits your budget? Dye Autos can help. Get in touch through our site >>here<< or give us a call at (303) 286-1665!

Read More

You’re ready to get rid of your current car and get yourself a new one. For many vehicle owners, there’s nothing easier than trading in a car to a local Denver dealer. That way, you avoid the time and effort it takes to list, find a buyer and sell your vehicle online; plus, dealers today are working to make the trade process fast, easy and transparent.

Before you visit the dealer, be sure to take these important steps:

- Use online tools to appraise your car’s value. Edmunds.com and kbb.com are two great resources to appraise your trade-in’s value.

- Be honest with yourself about your car’s trade-in condition. The more forthright you are when using online appraisal tools, the better off you’ll be when it comes time to trade it in. Very often, people come into the dealership with an overly-optimistic idea of what their car is worth, only to find that reality is less optimistic.

- Give your trade-in curb appeal.

- Clean the exterior and interior well.

- Remove small dents.

- Fix window glass defects.

- Bring all vehicle paperwork with you. You will need:

- Certificate of title (if you don’t have it, the DMV can tell you how to get it replaced). Note: if you have an outstanding loan on the vehicle, this will not apply since the bank has your certificate of title.

- Current registration.

- All your car keys and the owner’s manual.

- If you still have a loan on the car, you’ll need to have your account number or a payment stub.

- Maintenance records. These help support your claims about whatever prior damage your car has had and the repairs it has undergone.

When you arrive at the dealership

Inform your salesperson that you will be trading in a car. The salesperson will likely take down some of your information, then either the salesperson or a manager will perform a visual inspection of your vehicle, record the vehicle identification number and run the number through a vehicle history database to check its records.

The salesperson or manager may take your car for a quick drive to see how it runs.

Getting your trade-in offer

The trade-in offer you receive will depend on several factors, but mostly it will rely on the price being sought for similar vehicles at auction. Other possible factors include whether or not the dealer has similar cars on the lot already, the condition of your vehicle and whether the dealership needs to make any repairs to make your trade-in ready for other buyers.

Since you’re trading in your car in order to buy another one, negotiating the price for your trade-in will include the car you’re buying.

Paying off your trade-in’s loan & finishing up your deal

When you’re trading in a car, there may be a little more wiggle room on your trade-in value against the price of the car you’re hoping to buy.

When the amount you owe on the car is less than the trade-in value, the process is pretty straightforward. Say you still owe $5,000 on your car and a dealer offers you $6,000 for it as a trade-in. The dealer pays off the $5,000 loan for you and then you transfer ownership of the car to the dealer. You can use the difference (in this example it’s $1,000) as a down payment on the car you’re buying.

When the amount you own on the car is more than the trade-in value, the dealer still pays off your loan. This leaves a balance due to the dealer which you can either pay cash for, or sometimes, roll that amount into the new loan you’re getting on the new car. Various factors like creditworthiness, terms and payment amounts govern which options you’ll take.

Dye Autos helps people like you trade-in their cars and trucks everyday! Give us a call at (303) 286-1665 or contact us >>here<<. We’ll help you navigate the process of trading in a car and get you into the car of your dreams.

Read More3 Steps to Prepare Your Credit to Buy a Used Pickup Truck

If you’re looking to buy a used pickup truck, you’ve undoubtedly done your research in advance about the right model and options. The key to affording your dream ride works the same way: Get your financial situation under control before you make your final purchase decision.

If you’re looking to buy a used pickup truck, you’ve undoubtedly done your research in advance about the right model and options. The key to affording your dream ride works the same way: Get your financial situation under control before you make your final purchase decision.

Here are three crucial steps to take that will help you become more informed about your credit and help you set realistic expectations before you get to the dealership.

1. Know your credit score.

If you plan on using financing to buy a used pickup truck, your credit score is key to getting the lowest interest rates. Your credit score is a three-digit number that uses your credit information to assess how risky a borrower you are, and it can significantly influence how lenders decide the terms of your loan.

The higher your credit score, the lower your risk and the lower your interest rate. The lower your credit score, the riskier you are and the higher your interest rates. Be proactive in checking your credit score beforehand so you know where your credit stands before you apply for a loan.

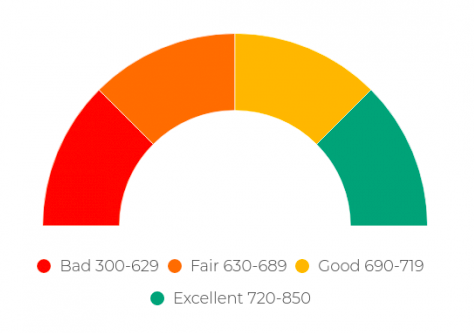

Credit score ranges:

2. Get a free credit report.

When you check your credit score, be sure to focus on where you fall in comparison to other consumers, and what areas of your credit are strong — and what might need some work.

FTC (Federal Trade Commission) Website: You’re entitled to one free copy of your credit report every 12 months from each of the three nationwide credit reporting companies. Order online from annualcreditreport.com, the only authorized website for free credit reports, or call 1-877-322-8228. You will need to provide your name, address, social security number, and date of birth to verify your identity.

3. Take steps to clear any blemishes on your credit.

Everybody wants the best deal possible when they’re ready to buy a used pickup truck. Banks base their financing offers on how well you’ve paid your debts so it’s crucial to clear any negative items off your credit report.

FACTS:

- One in five Americans are shocked to learn there are errors on their credit report.

- 79% of consumers who disputed credit report errors were successful in removing them.

If you have any blemishes on your credit report, take steps now to resolve them.

Example: If you’ve got a $48 collection on your report, make every attempt to make it right. If it’s a mistake, call the company and try to rectify it with them first. If that doesn’t produce results, dispute it with the credit reporting agencies. All three – Equifax, Experian and TransUnion – have simple forms on their sites for disputes.

If the $48 collection is not a mistake, make every attempt to remedy it, including paying it. You’ll save much more than the $48 in finance charges that lenders will be forced to charge you if you leave it on your report.

Pro Tip: Our finance manager at Dye Autos says, “90% of the collections we see are due to medical charges/fees. Call the company and try to negotiate down the amount you owe and set up a doable payment plan so that things will begin to look more positive.”

Wrapping it all up…

Are you ready to buy a used pickup truck but need help preparing your credit? We have over 70 years experience in the car and truck financing business and we can help you! Call Dye Autos at (303) 286-1665 or fill out our handy contact form >>here<<.

Read More

More than half of the vehicles sold in the U.S. are light-duty pickup trucks, SUVs and crossovers. There’s a big demand for used pickup trucks, both gas and diesel.

The used pickup truck market is estimated to be three times bigger than the new-truck market. Those who can’t afford to buy a new pickup, or who like to take advantage of some great deals, are always searching for the best deal on a used pickup truck.

At Dye Autos, we sell a lot of used pickup trucks.

Here are 5 important details to look for and consider when buying a used pickup truck.

1. Work with a dealer to set your budget.

It’s important to understand your budget and know what kind of truck you want. There are many options to choose from it’s crucial to set your expectations.

Start with an expert – a trusted dealer. At Dye Autos, we’ll help you determine what used pickup truck works for your lifestyle and your financial needs. We’ll give you a framework to work within so that shopping won’t get overwhelming.

2. Make a list to identify your wants and needs.

Many people approach buying a used pickup truck based on features they think they must have, rather than from a true evaluation of their needs. Making payments on a truck that’s too large or too small gets old real fast.

Consider these questions to identify your priorities.

- Is fuel mileage important, or are you willing to trade good fuel mileage for a larger engine with more power to tow and haul?

- Do you need a truck for occasional trips to the home improvement store or to the dump? A small truck with decent fuel economy might be the best choice.

- Is a 4WD truck a must for the roads you travel every day, or for snowy conditions in the winter?

- Do you regularly carry more than one passenger? Jump seats in a small second row are not suitable for more than short trips.

- Are you okay with either an automatic or manual transmission? Which accessories and/or safety features are must-haves? Jot down any characteristic that’s important to you and take it along when you shop.

3. Prioritize your lifestyle needs too.

Many people buy trucks for work but many others are just partial to diving pickup trucks. For them it’s a matter of lifestyle.

It’s important to make a list of the features most important to you that fit your lifestyle.

- Will you be hauling or transporting heavy materials?

- Do you drive mostly on highways or dirt and unpaved roads?

- Do you have kids that you’ll be driving back and forth to classes, soccer practice, dance recital, or school plays?

Prioritizing your lifestyle needs will help you decide which features you should be looking for first when shopping for your used pickup truck—be it larger cab space, a second row of seating, a stronger hitch, or a more powerful engine.

4. Get pre-approved.

At Dye Autos, we are the truck financing experts.

We’ve got 70 years of combined truck financing experience and 100 years in automotive retail. We’ve seen every situation and we can help you. How?

- We know what banks require.

- We often get customers approved while they’re here at the dealership.

- We have access to finance anyone.

- We’ll get you pre-approved faster than anyone.

Do you have a particular financing issue or concern? Let us help! Call us at (303) 286-1665 or contact us through our site >>here<< and we’ll put our experience to work for you.

5. Once you buy, stop looking.

Don’t second guess yourself!

You’ve done your homework, shopped around, found a trustworthy dealer, and made a careful decision. Now it’s time to enjoy your truck and not worry about the elusive truck that “got away.”

“If it’s a truck you wanna buy, you’d better call DYE!”

Read More Many car buyers prefer to trade in their current vehicle when getting another one because it’s easy. All you have to do is drive to the dealership, sign a your paperwork, and drive away in a different vehicle. What many buyers don’t know is that there are other benefits of trading in your car.

Many car buyers prefer to trade in their current vehicle when getting another one because it’s easy. All you have to do is drive to the dealership, sign a your paperwork, and drive away in a different vehicle. What many buyers don’t know is that there are other benefits of trading in your car.

One of the biggest benefits of trading in your car is that you can apply the trade-in credit to your down payment, thereby reducing the amount you need to finance. (ie: lowering your monthly payment!)

There can be tax advantages, too. Colorado and most other states require sales tax to be paid only on the difference between the price of your trade-in and the vehicle you’re buying, not the full price of the next car.

But this tax benefit doesn’t apply if you sell your old vehicle yourself!

Important tips when trading in your car

We’ve been selling trucks for a long time in the Denver/Wheat Ridge area. We’ve heard from customers like you who want to know “insider’s tips” on trading in your car. Here are four of our BEST tips!

- Give your trade-in curb appeal.

- Clean the exterior and interior well.

- Remove small dents.

- Fix window glass defects.

- Be honest with yourself about your car’s trade-in condition. The more forthright you are when using online appraisal tools, the better off you’ll be when it comes time to trade it in. Very often, people come into the dealership with an overly-optimistic idea of what their car is worth, only to find that reality is less optimistic.

- Don’t forget to pack all your car’s accessories. Trading in your car means you are trading in everything that goes along with it. Make sure the original owner’s manual and any extra keys are in the vehicle when you arrive at the dealership. Dealers like used cars that still have all the accessories and may even give you a better deal on your trade when everything is there.

- Bring all vehicle paperwork with you. You will need:

- Certificate of title (if you don’t have it, the DMV can tell you how to get it replaced). Note: if you have an outstanding loan on the vehicle, this will not apply since the bank has your certificate of title.

- Current registration.

- All your car keys and the owner’s manual.

- If you still have a loan on the car, you’ll need to have your account number or a payment stub.

- Maintenance records. These help support your claims about whatever prior damage your car has had and the repairs it has undergone.