Dye Autos Denver Area Truck and Automotive Blog

Why Car Dealerships Are The Best Place to Get a Car Loan

As car loan interest rates rise, the need becomes greater for consumers to work a little harder when shopping for the best deals.

As car loan interest rates rise, the need becomes greater for consumers to work a little harder when shopping for the best deals.

Shopping for a car loan can be just as daunting as shopping for a car. Most car shopping begins online. If you’ve ever done a Google search for “car loan,” you know how many hundreds of options are available.

But how do you choose which car loan is best? Here’s where your local car dealer can help.

Dealerships are the best place to get a car loan for many reasons…

It’s super convenient since you’re already at the dealer.

All of the bothersome paperwork — from title transfers to loan agreements — can be handled professionally at the dealership. The whole process goes more smoothly with this one-stop approach.

Using dealership financing sources makes it easier to access offers from multiple lenders at once. The easiest and best way to finance a vehicle is through the dealership where the vehicle is being purchased.

Dealerships have close relationships with all types of lenders.

Dealerships normally have dozens of lenders from which to choose. They work with lenders of all kinds – good credit, fair credit, bad credit – and consumers benefit from those relationships.

We’ve all experienced poor customer service and, with the consolidation of banks and other lenders, it doesn’t seem to be getting much better.

On the flip side, dealers are business members of your community and maintain good relationships with their portfolio of lenders. They are there to answer questions and help you, instead of putting you on hold or treating you like a “number.”

Dealerships have flexible lenders who are open to people who have lower credit scores.

For people who have blips on their credit history, dealers can leverage their good lender relationships to help them get a car loan, often when they’ve been rejected elsewhere.

Financial hardships can happen to anyone. There are many individuals who simply aren’t prepared for unexpected financial challenges such as job loss or medical bills. Having a close relationship with all types of lenders allows the dealer to find the right car loan for YOU.

At DYE Autos, we’ve worked with hundreds of credit-challenged customers here in the Denver – Wheat Ridge area and we understand how tough it can be. It’s a fact that lenders do lend to people who’ve been through hardship and we can help you.

Pro Tip: Always know your credit score. Your credit score is key to getting the lowest interest rate on your car loan.

Your credit score is a three-digit number that uses your credit information to assess how risky a borrower you are, and it can significantly influence how lenders decide the terms of your loan.

The higher your credit score, the lower your risk and the lower your interest rate. The lower your credit score, the riskier you are and the higher your interest rates. Be proactive in checking your credit score before you shop so you know where your credit stands before you apply for a loan.

Bonus tip: get pre-approved for a car loan.

Many dealers, like us at Dye Autos, offer an easy way for customers to get pre-approved.

This fast and easy process lets you choose how much you want to borrow based on the type of vehicle you’re looking for. Pre-approved truck financing with DYE Autos is just a click away. Visit this link >>>here<<< to get pre-qualified.

We’ll put our experience to work for you!

One of our helpful finance specialists will contact you to discuss available financing options.

“If it’s a truck you wanna buy, you’d better call DYE!”

Read More3 Steps to Prepare Your Credit to Buy a Used Pickup Truck

If you’re looking to buy a used pickup truck, you’ve undoubtedly done your research in advance about the right model and options. The key to affording your dream ride works the same way: Get your financial situation under control before you make your final purchase decision.

If you’re looking to buy a used pickup truck, you’ve undoubtedly done your research in advance about the right model and options. The key to affording your dream ride works the same way: Get your financial situation under control before you make your final purchase decision.

Here are three crucial steps to take that will help you become more informed about your credit and help you set realistic expectations before you get to the dealership.

1. Know your credit score.

If you plan on using financing to buy a used pickup truck, your credit score is key to getting the lowest interest rates. Your credit score is a three-digit number that uses your credit information to assess how risky a borrower you are, and it can significantly influence how lenders decide the terms of your loan.

The higher your credit score, the lower your risk and the lower your interest rate. The lower your credit score, the riskier you are and the higher your interest rates. Be proactive in checking your credit score beforehand so you know where your credit stands before you apply for a loan.

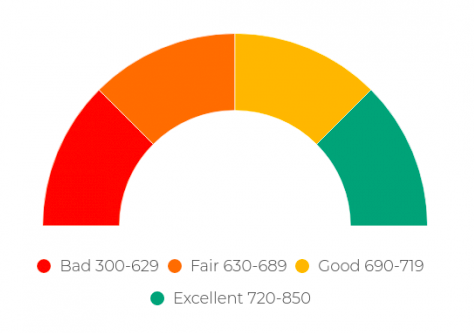

Credit score ranges:

2. Get a free credit report.

When you check your credit score, be sure to focus on where you fall in comparison to other consumers, and what areas of your credit are strong — and what might need some work.

FTC (Federal Trade Commission) Website: You’re entitled to one free copy of your credit report every 12 months from each of the three nationwide credit reporting companies. Order online from annualcreditreport.com, the only authorized website for free credit reports, or call 1-877-322-8228. You will need to provide your name, address, social security number, and date of birth to verify your identity.

3. Take steps to clear any blemishes on your credit.

Everybody wants the best deal possible when they’re ready to buy a used pickup truck. Banks base their financing offers on how well you’ve paid your debts so it’s crucial to clear any negative items off your credit report.

FACTS:

- One in five Americans are shocked to learn there are errors on their credit report.

- 79% of consumers who disputed credit report errors were successful in removing them.

If you have any blemishes on your credit report, take steps now to resolve them.

Example: If you’ve got a $48 collection on your report, make every attempt to make it right. If it’s a mistake, call the company and try to rectify it with them first. If that doesn’t produce results, dispute it with the credit reporting agencies. All three – Equifax, Experian and TransUnion – have simple forms on their sites for disputes.

If the $48 collection is not a mistake, make every attempt to remedy it, including paying it. You’ll save much more than the $48 in finance charges that lenders will be forced to charge you if you leave it on your report.

Pro Tip: Our finance manager at Dye Autos says, “90% of the collections we see are due to medical charges/fees. Call the company and try to negotiate down the amount you owe and set up a doable payment plan so that things will begin to look more positive.”

Wrapping it all up…

Are you ready to buy a used pickup truck but need help preparing your credit? We have over 70 years experience in the car and truck financing business and we can help you! Call Dye Autos at (303) 286-1665 or fill out our handy contact form >>here<<.

Read MoreLooking for a Bad Credit Car Loan? Don’t Forget These Important Steps

Many of our customers tell us that shopping for a bad credit car loan is just as challenging as shopping for a car. We’ve compiled a list of 9 steps to help you navigate the waters of car and truck loans when your credit is not as good as you’d hoped.

Many of our customers tell us that shopping for a bad credit car loan is just as challenging as shopping for a car. We’ve compiled a list of 9 steps to help you navigate the waters of car and truck loans when your credit is not as good as you’d hoped.

A low credit score is generally defined as a FICO score under 629. You can have a lower score for a variety of reasons, including a history of making late payments, identity theft or simply not having enough years of credit history. Your credit score dictates what type of interest you’ll end up paying on your car loan, and a low score means a higher interest rate.

1. Work on your credit before you start shopping.

Check your credit report as soon as you start thinking about buying a car or truck, even if it’s months or years in advance.

By cleaning up your credit before applying for a loan, you improve your chances of being approved with decent terms. Cleaning up your credit will include paying off past due accounts, disputing credit report errors, and adding positive information to your credit report.

2. Don’t assume the worst.

Never take someone else’s word that your credit is bad. Check for yourself by obtaining your credit report and credit score.

You are entitled to a free credit report from each of the three credit reporting agencies (Equifax, Experian, and TransUnion) once every 12 months. You can request all three reports at once, or space them out throughout the year.

3. Shop around.

When you’ve got bad credit, “you’re likely to agree with just about anything a lender offers you. But you shouldn’t just take the first offer you get,” warns Chris Kukla, senior vice president at the nonprofit Center for Responsible Lending.

Look for ways to save money on a car loan:

- Shorter term

- Factor in all the costs (insurance, gas, parking fees, etc)

- Get 2-3 quotes

- Make additional payments if you can

4. Start close to home.

Even if you don’t think you can get a loan, go to your bank or your credit union first. Apply at the bank where you have a checking account or your credit union. And see if your employer or insurance company offers auto financing.

Lenders who know you may provide better rates and terms.

5. Seek out a trustworthy dealer.

Believe it or not, car dealers have pretty great car loan options. They work with banks every single day and can often match or have better rates than what you’ve found in your search.

Trust is important and many dealers will work hard to keep yours. If you’ve done business with a dealer before or someone has recommended one (even through Yelp or Google reviews), include a call to your dealer in your purchase process.

6. Don’t go it alone.

Ask a friend or relative to go with you. It’s always better to have a separate pair of eyes and ears when making big decisions.

7. Pay attention to loan terms, not monthly payments.

Look for the lowest annual percentage rate (APR) over the shortest period of time. Write everything down.

If the terms are beyond your means, then consider a different vehicle at a lower price.

Focusing on monthly payments could cause you to pay more much more in financing costs.

8. Be aware of “extras.”

The Center for Responsible Lending advises that car buyers should never allow the loan to be contingent on purchasing any add-on, such as extended warranties, after-market services and even insurance.

9. Get Pre-Approved.

This fast and easy process lets you choose how much you want to borrow based on the type of vehicle you’re looking for. You’ll know ahead of time what to expect…and that means less anxiety and more peace of mind.

Let Dye Autos put our experience to work for you. Pre-approved car and truck financing with DYE Autos is just a click away. Visit this link >>>here<<<!.

One of our helpful finance specialists will contact you to discuss available financing options, including the amount you’re qualified to finance.